- Top 8 Advantages of Marine Insurance

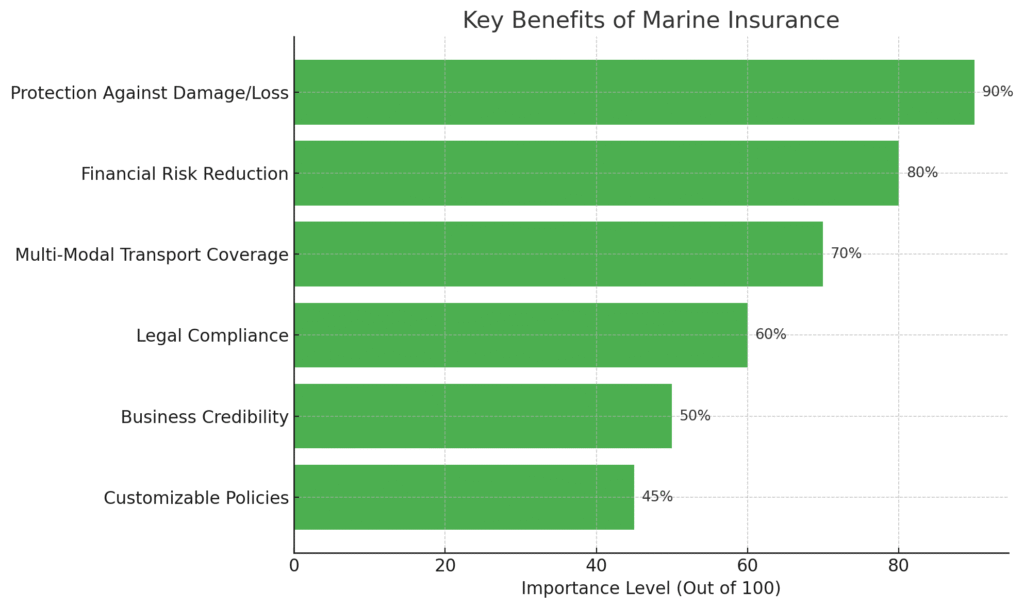

- 1. Protection Against Loss or Damage

- 2. Coverage for Multiple Modes of Transport

- 3. Reduces Financial Risk for Your Business

- 4. Builds Business Credibility and Trust

- 5. Legal and Contractual Compliance

- 6. Flexible and Customizable Policies

- 7. Peace of Mind for Business Owners

- 8. Claims Support and Professional Assistance

- When Should You Get Marine Insurance?

Shipping goods across borders is a vital part of global trade. Whether it’s by sea, air, or land, transporting cargo involves a fair amount of risk. Goods can be lost at sea, damaged in storms, or even stolen during transit. For businesses that rely on the safe and timely delivery of their products, these risks can lead to serious financial losses.

Marine insurance is a must-have for companies involved in the transportation of goods. It provides coverage for cargo against loss, damage, or theft during transit. This blog explores the many advantages of marine insurance and why it’s a smart investment for businesses of all sizes.

Top 8 Advantages of Marine Insurance

1. Protection Against Loss or Damage

This is the most obvious and important benefit. Goods in transit can be damaged due to:

- Accidents during loading or unloading

- Natural disasters like storms or floods

- Fire or explosions

- Theft or piracy

With marine insurance, the financial cost of these events is covered. Instead of suffering a huge loss, the insurer compensates you for the value of the goods lost or damaged.

2. Coverage for Multiple Modes of Transport

Modern logistics often involves a combination of sea, air, road, and rail. For example, a product may be shipped from a factory in China to a port by truck, then carried across the ocean by ship, and finally delivered by train to a warehouse in Europe.

Marine insurance can cover all legs of this journey, not just the part that happens at sea. This ensures your cargo is protected from start to finish.

3. Reduces Financial Risk for Your Business

Shipping goods involves a significant investment. If a container of goods is lost or damaged, it could cause major financial harm especially for small and medium-sized businesses.

Marine insurance helps reduce that risk. Even if something goes wrong during transit, the insurance company bears the financial burden, not your business. This allows you to operate with confidence and financial stability.

| Advantage | Description | Why It Matters |

|---|---|---|

| Protection Against Loss/Damage | Covers goods lost or damaged due to accidents, natural disasters, or theft. | Prevents financial loss from unexpected incidents during transit. |

| Financial Risk Reduction | Minimizes financial exposure from high-value shipments or cargo losses. | Keeps business operations stable even after major shipping mishaps. |

| Multi-Modal Transport Coverage | Provides insurance for sea, air, and land transportation. | Ensures full coverage from origin to final destination, regardless of transport. |

| Legal and Contractual Compliance | Meets requirements under international trade agreements like CIF or CIP terms. | Helps avoid legal penalties or contract breaches in global trade. |

| Business Credibility | Shows professionalism and commitment to safe cargo handling. | Builds trust with partners, clients, and suppliers. |

| Customizable Policies | Allows choosing policies based on business type, shipping frequency, and goods. | Helps manage insurance costs and align coverage with business needs. |

| Peace of Mind | Reduces worry about cargo safety and delivery delays. | Lets businesses focus on growth and customer satisfaction. |

| Claims Assistance & Support | Insurance companies help with quick and fair claim processing. | Saves time and effort in case of an incident, ensuring faster recovery. |

4. Builds Business Credibility and Trust

Having marine insurance shows customers, suppliers, and partners that your business is reliable and responsible. In many industries, it’s standard practice to have insurance for all shipments. Some clients may even require proof of insurance before doing business with you.

Marine insurance demonstrates that you are prepared for uncertainties and that you take cargo protection seriously. This builds trust and can help you win more business.

5. Legal and Contractual Compliance

In many international trade agreements, marine insurance is not just a recommendation—it’s a requirement. If you’re using international shipping terms like CIF (Cost, Insurance, and Freight) or CIP (Carriage and Insurance Paid To), you are legally obligated to have insurance.

Even when it’s not a legal requirement, many shipping contracts and trade regulations demand some level of cargo insurance. Marine insurance helps ensure your business remains compliant with these rules.

6. Flexible and Customizable Policies

Marine insurance is highly customizable. You can choose the type of policy that best suits your shipping needs:

- Voyage Policy: Covers a single trip or shipment.

- Time Policy: Covers all shipments during a specific time period (e.g., 6 months).

- Open Policy: Designed for businesses that ship goods regularly, covering multiple shipments under one contract.

This flexibility allows you to control costs and tailor coverage to your exact needs.

7. Peace of Mind for Business Owners

Running a business is stressful enough without having to worry about lost or damaged shipments. Marine insurance offers peace of mind. You know that, even in the worst-case scenario, your cargo is protected and your business won’t take a major financial hit. This allows you to focus on more important things—like serving customers and growing your business.

8. Claims Support and Professional Assistance

When something goes wrong during shipping, it can be difficult to deal with on your own. Marine insurance companies often provide claims support and expert guidance to help you navigate the process. This makes it easier and faster to recover your losses.

Some insurers even offer risk management advice to help you prevent future losses.

When Should You Get Marine Insurance?

If you:

- Export or import goods internationally

- Rely on logistics providers for large shipments

- Handle high-value goods

- Ship fragile or perishable items

- Want to protect your investment

Then marine insurance is not optional—it’s essential.

Whether you’re a small business shipping once a month or a large company with daily shipments, having the right insurance coverage can make a huge difference.

Final Thought

Marine insurance is a valuable tool for protecting your goods, minimizing risk, and ensuring smooth operations in the world of logistics and trade. The cost of coverage is small compared to the potential losses you could face without it. In today’s global market, where supply chains stretch across continents and oceans, having marine insurance is no longer just a safety net—it’s a strategic advantage.

FAQ’s

What are the advantages of marine insurance?

Marine insurance protects ships, cargo, and goods during transport over water. It covers losses from accidents, bad weather, theft, or damage. The main advantages are:

- Financial protection – You get paid if goods or ships are lost or damaged.

- Risk transfer – The insurance company takes on the risk, not you.

- Peace of mind – You can ship goods without worrying about big losses.

- Legal help – It helps you meet legal and trade requirements.

- Builds trust – Insured shipments make customers and partners feel safer.

What are the three types of marine insurance?

The three main types of marine insurance are:

- Hull Insurance

- Covers physical damage to the ship or vessel itself.

- Cargo Insurance

- Covers goods or cargo being transported against loss or damage.

- Liability Insurance (Protection & Indemnity or P&I Insurance)

- Covers legal liabilities like damage to other ships, injury to crew, or environmental damage (e.g., oil spills).

These types protect different parts of marine transport depending on what’s at risk.

What are the benefits of marine resources?

Benefits of Marine Resources :

Recreation – Offers opportunities for tourism, sports, and leisure activities.

Food Supply – Provides fish, seafood, and sea plants for human consumption.

Economic Value – Supports fishing, shipping, tourism, and trade industries.

Energy – Source of oil, gas, and renewable energy like tidal and wind power.

Medicine – Marine organisms are used in developing medicines.

Climate Regulation – Oceans absorb carbon dioxide and regulate temperature.

Biodiversity – Home to a vast variety of marine life.