What is Family Floater Health Insurance?

Summary:

- Definition: A single health insurance policy covering the entire family with a shared sum insured.

- Key Features:

- Single policy and premium for all family members

- Shared coverage amount among members

- Covers self, spouse, dependent children, and sometimes dependent parents

- Benefits:

- Convenient

- Cost-effective

- Simplified claims process

- Considerations:

- Shared coverage risk

- Suitable for smaller, healthier families

- Ideal For:

- Small to medium-sized families

- Families with younger children

- Healthier families seeking basic coverage

- Actionable Step:

- Assess family health needs and compare policies before selecting a Family Floater Health Insurance plan.

Table of Contents

- Introduction

- Key Features of Family Floater Health Insurance

- Benefits of Family Floater Health Insurance

- Considerations and Potential Drawbacks

- Who Should Opt for Family Floater Health Insurance?

- How to Choose the Right Family Floater Policy

- Claim Process for Family Floater Health Insurance

- Conclusion

- Frequently Asked Questions (FAQs)

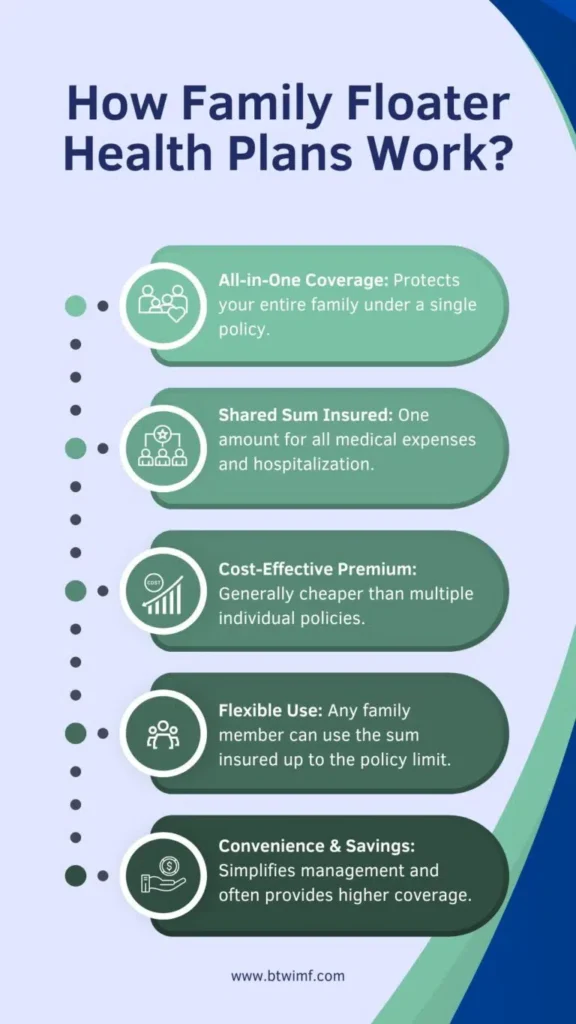

1. Introduction

Family Floater Health Insurance is a comprehensive health insurance plan designed to cover the entire family under a single policy. This type of insurance offers a shared sum insured (coverage amount) that can be utilized by any or all family members during the policy period. The primary advantage of family floater plans is their convenience and cost-effectiveness, making them an attractive option for many families.

2. Key Features of Family Floater Health Insurance

- Single Policy, Single Premium:

- Covers the entire family with one policy document.

- A single annual or monthly premium payment for all members.

- Shared Sum Insured (Coverage Amount):

- The total coverage amount is shared among all family members.

- Example: A ₹10 lakhs policy can be used by any family member or distributed among multiple members during the policy year.

- Family Members Covered:

- Self (Policyholder)

- Spouse

- Dependent Children: Up to a certain age (usually 18-25 years, with some policies covering until marriage).

- Dependent Parents: Covered in some policies, often with additional premium.

- Newborns: Some policies automatically cover newborns for a certain period, after which you can officially add them to the policy.

- Claims Utilization:

- If one member uses a portion of the sum insured, the remaining amount is available for other family members.

- Renewal and Pre-Existing Conditions:

- Applies to the policy as a whole.

- Waiting periods for pre-existing conditions are usually policy-wide, not per individual.

- Add-ons and Riders:

- Optional additional coverage for critical illnesses, personal accidents, etc.

- May require additional premiums.

3. Benefits of Family Floater Health Insurance

- Convenience:

- Single policy to manage for the entire family.

- Simplified paperwork and renewals.

- Cost-Effective:

- Often cheaper than buying individual policies for each family member.

- Economical for families with younger, healthier members.

- Simplified Claims:

- Easier to manage and track claims with a single policy.

- Reduced administrative hassle.

- Automatic Coverage for Newborns:

- Many policies offer automatic coverage for newborns for a specified period.

- Get expert advice from a licensed insurance professional to secure your future

4. Considerations and Potential Drawbacks

- Shared Coverage Risk:

- If one member consumes a large portion of the sum insured, others may not have enough coverage left.

- Particular concern for larger families or those with ongoing medical conditions.

- Dependent on Family Size and Health:

- Larger families or those with pre-existing conditions might find individual policies more suitable to ensure adequate coverage for each member.

- Healthier, smaller families might benefit more from the cost savings.

- Age-Related Premium Increases:

- Premiums may significantly increase as the oldest member ages.

- Review policy terms for age-related premium hikes.

5. Who Should Opt for Family Floater Health Insurance?

- Small to Medium-Sized Families:

- Typically 2-4 members, depending on the insurer’s definition.

- Families with Younger Children:

- Especially beneficial until children grow up and may require separate policies.

- Healthier Families:

- Those with minimal pre-existing conditions or ongoing medical needs.

- Budget-Conscious Families:

- Looking for a cost-effective way to ensure basic health coverage for all members.

6. How to Choose the Right Family Floater Policy

- Assess Family Health Needs:

- Consider pre-existing conditions, age, and lifestyle factors.

- Evaluate Sum Insured:

- Ensure it’s sufficient for your family’s potential medical expenses.

- Check Coverage and Exclusions:

- Understand what’s covered and what’s not.

- Compare Premiums:

- Balance cost with the coverage and services offered.

- Look for Additional Benefits:

- Automatic newborn coverage, free health check-ups, etc.

- Insurer’s Reputation and Claim Settlement Ratio:

- Choose an insurer with a good track record for claims and customer service.

7. Claim Process for Family Floater Health Insurance

- Notify the Insurer:

- Inform your insurance provider as soon as possible about the hospitalization or medical need.

- Provide Required Documents:

- Hospital bills, discharge summary, ID proofs, etc.

- Cashless or Reimbursement Claim:

- Cashless at network hospitals or reimbursement for non-network hospitals.

- Claim Settlement:

- The insurer settles the claim as per policy terms, deducting the amount from the shared sum insured.

8. Conclusion

Family Floater Health Insurance offers a convenient, cost-effective solution for families seeking comprehensive health coverage. While it’s particularly beneficial for smaller, healthier families, it’s essential to weigh the pros and cons based on your family’s unique needs and circumstances. Always carefully review policy terms, coverage, and the insurer’s reputation before making a decision.

FAQ: Family Floater Health Insurance

- Can a Family Floater policy cover both traditional and alternative medicine treatments?

Yes, some Family Floater policies may include coverage for alternative treatments such as Ayurveda, Homeopathy, or Acupuncture. It’s important to check the specifics with your insurer to ensure these treatments are covered under your plan.

- Can I include extended family members in a Family Floater policy?

Most Family Floater plans cover the policyholder, spouse, and children. Some insurers may also allow coverage for parents or in-laws, but this can vary by provider. It’s important to check with your insurer for specific eligibility criteria.

- How is the sum insured shared among family members?

The sum insured is a shared limit for all insured members. For instance, if the sum insured is ₹500,000, it means that up to ₹500,000 can be used by the entire family collectively throughout the policy year. The amount used by one member reduces the remaining amount available for others.

- What happens if one family member exhausts the sum insured?

Once the total sum insured is exhausted, no further claims can be made under the same policy for the current policy year. This makes it crucial to choose an adequate sum insured based on the family’s health needs and potential medical expenses.

- Are pre-existing conditions covered under Family Floater plans?

Coverage for pre-existing conditions varies by insurer and plan. Many Family Floater policies have a waiting period before pre-existing conditions are covered. It’s advisable to review the policy documents or consult with the insurance provider to understand the specifics.

- Can I add more members to the policy later on?

Most Family Floater policies allow you to add new family members, such as a newborn child, by updating the policy. Some insurers may have specific terms and conditions for adding members, so it’s best to check with them for details.

- How do premiums for Family Floater plans compare to individual policies?

Family Floater plans often have lower premiums compared to the total cost of individual policies for each family member. However, the exact premium depends on factors like the sum insured, age of members, and coverage options.

- What are the common exclusions in Family Floater Health Insurance?

Common exclusions might include pre-existing conditions during the waiting period, certain high-risk activities, and cosmetic procedures. It’s essential to read the policy documents carefully to understand what is and isn’t covered.

- How can I choose the right Family Floater plan for my family?

To select the best Family Floater plan, consider factors like the sum insured, coverage benefits, network hospitals, and premium costs. Assess your family’s health needs and financial situation to choose a plan that offers the right balance between coverage and affordability.

- Can Family Floater policies help with preventive care?

Some Family Floater policies offer coverage for preventive health check-ups, vaccinations, and wellness programs. Check with your insurer to see if these benefits are included and if there are any limits or conditions attached.

- What should I do if I need to make a claim?

To make a claim, you typically need to inform the insurer, provide necessary documents, and follow the claims process outlined in your policy. This may include hospital bills, medical reports, and a claim form. Promptly notifying your insurer can help ensure a smoother claims experience.

- How does a Family Floater policy handle coverage if a family member travels abroad?

Family Floater policies usually cover medical emergencies abroad, but coverage details can vary. Verify with your insurer if international coverage is included and if there are any limits or exclusions for overseas medical expenses.

- What impact does a family member’s chronic illness have on the policy’s premium renewal?

A chronic illness in one family member might not directly affect the premium at renewal, as Family Floater policies generally renew based on the overall risk profile of the entire family. However, the insurer may adjust premiums based on claim history or policy terms.

- Can a Family Floater policy be used for outpatient consultations and treatments?

Some Family Floater policies include coverage for outpatient consultations and treatments, such as doctor visits, diagnostic tests, and minor procedures. Check the policy details to confirm what outpatient services are covered.

- How does a Family Floater policy address health coverage if a family member is undergoing a long-term treatment?

Long-term treatments can exhaust the sum insured more quickly. If a family member requires ongoing treatment, the policy may cover these expenses until the sum insured is depleted. It’s important to choose an adequate sum insured and understand how long-term treatments are managed under the policy.

- What happens to the coverage if a family member moves out of the household?

If a family member covered under the policy moves out, you might need to update the policy to reflect the change. Some insurers allow continued coverage for moved-out members, but it’s essential to review the policy terms and inform the insurer.

- Are there any specific benefits for families with young children in a Family Floater policy?

Some Family Floater policies offer additional benefits for young children, such as coverage for vaccinations, pediatric consultations, or wellness check-ups. Explore these benefits to see if they align with your family’s needs.

- Can a Family Floater policy be used to cover family members who are living with disabilities?

Yes, a Family Floater policy can cover family members with disabilities, but it’s crucial to disclose any pre-existing conditions and disabilities during the policy purchase. Ensure that the policy provides adequate coverage for specific needs and treatments.

- How does the policy handle coverage if a family member is pregnant?

Pregnancy-related expenses might be covered under some Family Floater policies, including maternity benefits and newborn care. Check the policy to understand the extent of coverage for maternity and childbirth, including any waiting periods.

- Can a Family Floater policy be customized for specific health needs or preferences?

Many insurers offer customizable Family Floater policies where you can choose additional riders or benefits based on your family’s unique health needs. This could include coverage for critical illnesses, wellness programs, or specific diseases.

- How does the policy support preventive health measures for the whole family?

Some Family Floater policies offer support for preventive health measures, such as annual health check-ups, screenings, and wellness incentives. Investigate these features to promote proactive health management for your family.

- What are the advantages of choosing a Family Floater policy over multiple individual plans in terms of tax benefits?

A Family Floater policy might offer better tax benefits under provisions such as Section 80D of the Income Tax Act, compared to individual plans. Check with a tax advisor to understand how different policy types impact your tax savings.