Introduction

Marine insurance premiums depend on more than just the value of a vessel and its cargo; they are influenced by various risk criteria. Understanding marine insurance premium factors helps shipowners, cargo handlers, and logistics managers make informed choices.

Knowing the main factors can help you get the right coverage without overspending, and it ensures you receive clear quotes. This knowledge allows them to balance risk, coverage, and cost effectively.

Major Marine Insurance Premium Factors

- Vessel Characteristics and Condition

The age, size, construction, and maintenance history of a vessel impact its risk assessment. Older or poorly maintained vessels generally have higher premiums. In contrast, modern ships with current classification certificates are rated lower. - Cargo Type and Declared Value

High-value, fragile, or hazardous cargo, such as electronics, perishables, or chemicals, carries more risk and therefore draws higher premiums compared to uniform bulk goods. - Trade Routes and Navigational Hazards

Shipping through high-risk areas, such as piracy-prone regions or conflict zones like the Red Sea or Strait of Hormuz, often results in war-risk surcharges that can double premiums. - Claims History

A history of frequent claims leads to higher premiums, as underwriters see them as indicators of future losses. Having a clean record can greatly reduce rates. - Risk Management and Safety Measures

Improved safety practices, like regular crew training, pre-shipment inspections, and IoT monitoring, indicate lower risk to underwriters and may lead to premium discounts. - Coverage Terms and Endorsements

Choosing broader policies, like all-risk coverage, or adding endorsements such as war-risk, delay-in-transit, or SRCC will increase your premiums. - Market Conditions and Reinsurance Costs

Global supply and demand, inflation, and reinsurance prices can indirectly raise premiums, especially when the shipping market is active.

Previous Incidents

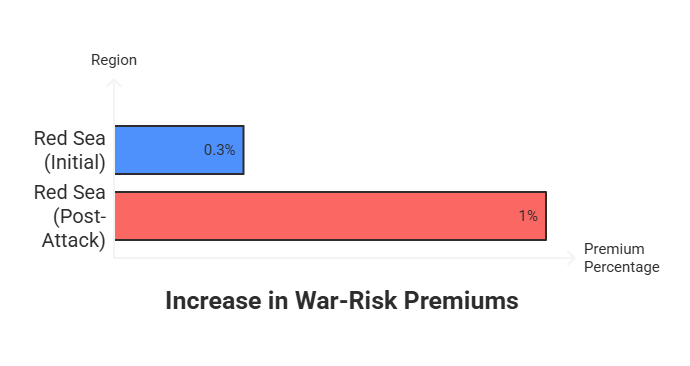

War-risk premiums in the Red Sea rose from 0.3% to around 1% of vessel value after Houthi attacks.

Premiums for the Strait of Hormuz increased from 0.2–0.3% to about 0.5% due to regional tensions.

In 2022, global marine insurance premiums reached $35.8 billion, an increase of 8.3% from the previous year.

Comparison Table of Premium Factors

| Risk Factor | Effect on Premiums |

|---|---|

| Vessel age & condition | Older or poorly maintained = higher rates |

| Cargo type/value | High-risk cargo increases premiums |

| Shipping route | High-risk zones = war-risk surcharge |

| Claims history | Frequent claims = higher future costs |

| Risk management practices | Strong protocols = lower premiums |

| Coverage breadth | Added endorsements increase costs |

| Insurer market trends | Market-wide shifts affect pricing |

Why These Factors Matter

Transparent Pricing: Understand the reasons behind higher quotes.

Optimizing Costs: Improve risk management to lower premiums.

Policy Structure: Choose endorsements based on route and cargo risks.

How BTW IMF Can Help

We evaluate your operations to pinpoint essential marine insurance premium factors and tailor coverage to fit.

We recommend endorsements like war-risk or delay-in-transit when necessary for particular routes.

We help negotiate premiums, leveraging safety measures and loss history to secure better rates.

Contact BTW IMF for a personalized assessment and insurance planning that reflect your actual risk profile.

Conclusion

Knowing the factors that impact marine insurance premiums allows you to balance coverage, cost, and risk effectively. By enhancing safety, selecting appropriate policy options, and making informed routing choices, you can align insurance strategies with business objectives.

Reach out to BTW IMF to optimize your marine policy, because effective shipping starts with smart coverage.