Finding the best marine insurance is essential for protecting goods in transit. Here’s a complete checklist to make sure you select coverage that aligns with your specific needs how to choose marine insurance done right:

1. Understand Your Coverage Needs ✅

Start by identifying what you’re insuring: cargo, hull, or liability.

Ask yourself:

- What is the value and type of cargo?

- Which shipping routes and risks (like piracy, war zones, delays) are involved?

Once you clearly define your exposures, you’ll know how to choose marine insurance that fits your unique business risks.

2. Select the Appropriate Policy Type ✅

- Voyage coverage for single shipments

- Time/mixed coverage for a set period

- Floating cover (open policy) for frequent shippers

Knowing the right policy structure is essential in choosing marine insurance based on your shipping patterns.

3. Pick a Reputable Insurer ✅

Choose an IRDAI-approved insurer (in India) or a respected market underwriter like Lloyd’s or Allianz. Look for:

- Strong financial stability

- High claim settlement ratios

Verifying trustworthiness is key when learning how to choose marine insurance wisely.

4. Review Coverage Limits & Exclusions ✅

Ensure the policy matches your declared cargo value. Read the PDS carefully to understand what’s not covered:

Common exclusions include wear and tear, inherent vice, poor packing, war, and delays.

If your supply chain faces certain risks, like political instability or natural disasters, ask about additional endorsements. This is central to how to choose marine insurance without surprises.

5. Assess Deductibles & Claim Limits ✅

Determine:

- Your out-of-pocket deductible

- Any per-claim cap before coverage applies

Comparing these helps manage costs and is a vital step in how to choose marine insurance that balances premiums and exposure.

6. Understand the Claims Process ✅

A responsive claims process matters as much as coverage. Confirm:

- Required documentation (invoices, surveyor reports)

- Turnaround time for claims

Transparent claim support is essential when you’re figuring out how to choose marine insurance effectively.

7. Value-Add Services & Risk Management ✅

Some insurers offer extra services like pre-shipment inspections, packaging guidelines, or IoT-based tracking to reduce risk and premiums. These features can help you decide how to choose marine insurance.

8. Review Coverage Periodically ✅

As your business grows or changes routes and cargo types, revisit and adjust your policy as needed. This ongoing review ensures you follow best practices for how to choose marine insurance.

9. Seek Expert Advice ✅

When shipping complex or high-value goods, consult a marine insurance broker or specialist. Their guidance can be invaluable in mastering how to choose marine insurance that suits your operations.

Key policy types:

- Voyage

- Time/mixed

- Floating

Top exclusions to know: wear and tear, inherent vice, packing, war, delays

Additional services: pre-shipment inspection, packaging advice, IoT tracking

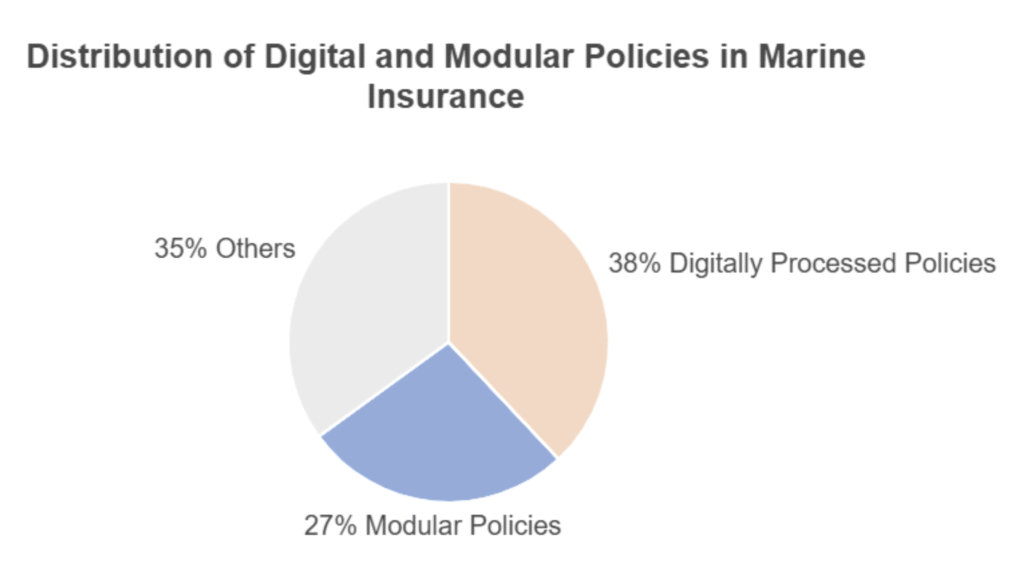

Marine Insurance Today

- 38% of marine insurance policies are now digitally processed, allowing faster quotes and streamlined documentation.

- 27% of underwriters offer modular policies tailored to specific cargo types—helping businesses choose only what they actually need.

Final Notes

Remember, choosing marine insurance isn’t just about finding the cheapest policy. It’s about selecting the right coverage that matches your cargo value, routes, and risk profile while ensuring smooth claims and risk management. Use this checklist to guide your decision and seek help from experts like BTW IMF while looking for Marine Insurance.