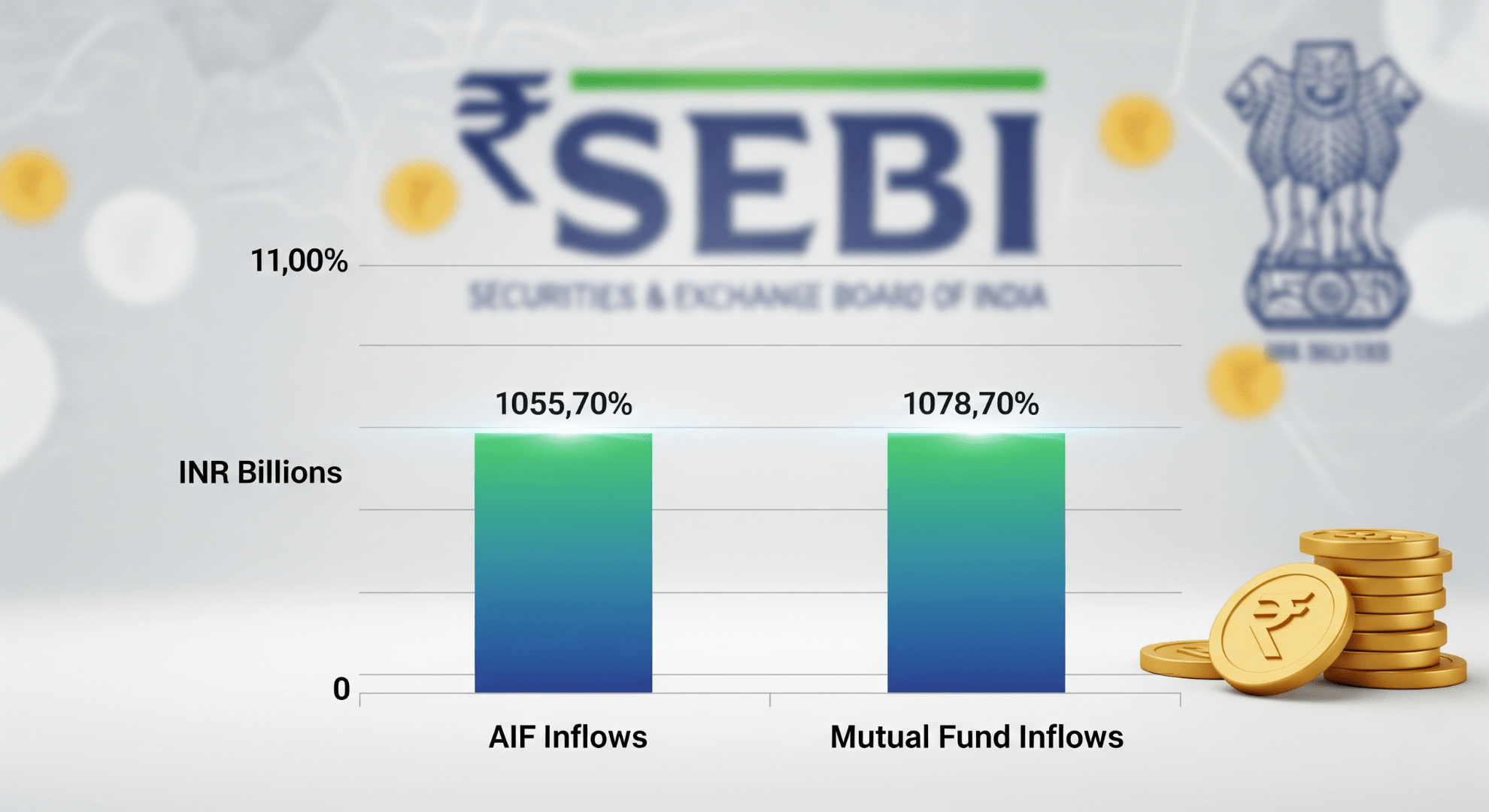

At the FICCI Annual Capital Markets Conference 2025, SEBI Whole Time Member (WTM) Ananth Narayan G highlighted that inflows into Alternative Investment Funds (AIFs) during FY25 were on par with those seen in mutual funds.

Providing context, he noted that net commitments in AIFs had surged from ₹2.20 lakh crore to ₹13.50 lakh crore, while actual investments grew from ₹1.30 lakh crore to ₹5.40 lakh crore over the same period. AIFs now cater to more than 70,000 unique investors.

Ananth praised Category I and Category II AIFs, which together account for 75% of total commitments, calling them strong vehicles for channeling risk-capital into private markets.

He also underlined the growing relevance of the accredited investor framework. Pointing out that obtaining accreditation has become easier and entirely digital, he encouraged more industry participants to register and provide feedback to further streamline the process.