- Introduction to Marine Insurance

- Why Mumbai is the Hub for Marine Insurance

- Types of Marine Insurance Policies Offered

- Top Marine Insurance Companies in Mumbai

- Key Features to Look for in Marine Insurance Providers

- How to Choose the Right Marine Insurance Company

- Cost of Marine Insurance in Mumbai

- Benefits of Buying Marine Insurance in Mumbai

- Challenges Faced by Marine Insurance Sector in Mumbai

- Online vs Offline Marine Insurance in Mumbai

- Case Studies of Successful Marine Insurance Claims

- Future of Marine Insurance in Mumbai

- FAQ’s

Introduction to Marine Insurance

Marine insurance might sound niche, but it plays a massive role in the world of trade and transport. If you’re dealing with goods or ships, you can’t ignore it.

What is Marine Insurance?

Simply put, marine insurance protects ships, cargo, and terminals against loss or damage. Whether you’re shipping across the sea or navigating inland waters, it’s your financial safety net.

Importance of Marine Insurance in Trade and Commerce

Marine insurance is the backbone of international trade. With billions of rupees worth of goods moving in and out of Mumbai daily, this insurance shields businesses from massive losses.

Why Mumbai is the Hub for Marine Insurance

Strategic Location and Port Connectivity

Mumbai has one of India’s largest ports—Jawaharlal Nehru Port Trust (JNPT). This makes it the prime location for marine transport and, naturally, marine insurance companies.

Financial and Shipping Capital of India

From stock markets to shipyards, Mumbai has it all. With shipping and finance industries booming, marine insurance thrives here.

Types of Marine Insurance Policies Offered

Hull Insurance

This covers physical damage to the ship itself. Think of it as car insurance, but for vessels.

Cargo Insurance

Covers the goods being transported, whether by sea, rail, or road.

Freight Insurance

Protects against loss of freight income in case the cargo is lost or damaged.

Liability Insurance

Protects shipowners from third-party liabilities like collisions or environmental damage.

Top Marine Insurance Companies in Mumbai

1. New India Assurance Co. Ltd.

One of the oldest and most trusted players. With a solid network and wide marine insurance offerings, they’re often a first choice.

2. United India Insurance Company

Backed by the government and known for its quick claim settlement and customer service.

3. ICICI Lombard General Insurance

A private player offering advanced tech tools, easy online policy issuance, and great customizations.

4. Tata AIG General Insurance

They bring global standards with local expertise. Popular among exporters and logistics companies.

5. HDFC ERGO Marine Insurance

Tech-friendly, transparent, and quick to respond. HDFC ERGO is growing fast in this space.

6. Oriental Insurance Company

An experienced PSU insurer with a wide product range and industry trust.

Key Features to Look for in Marine Insurance Providers

Policy Coverage

Ensure your policy covers damages, piracy, war risks, and inland transit.

Claim Process

A hassle-free and quick claim process can make or break your experience.

Premium Rates

Always compare rates before locking in. Don’t just go for the cheapest; go for value.

Customer Service and Support

A dedicated relationship manager or support team helps in emergencies.

How to Choose the Right Marine Insurance Company

Compare Plans and Benefits

Use comparison tools or consult a broker to weigh all your options.

Read Reviews and Ratings

Customer testimonials are gold. They reveal how companies really perform.

Assess Claim Settlement Ratios

A high claim settlement ratio means the insurer is reliable when you need them most.

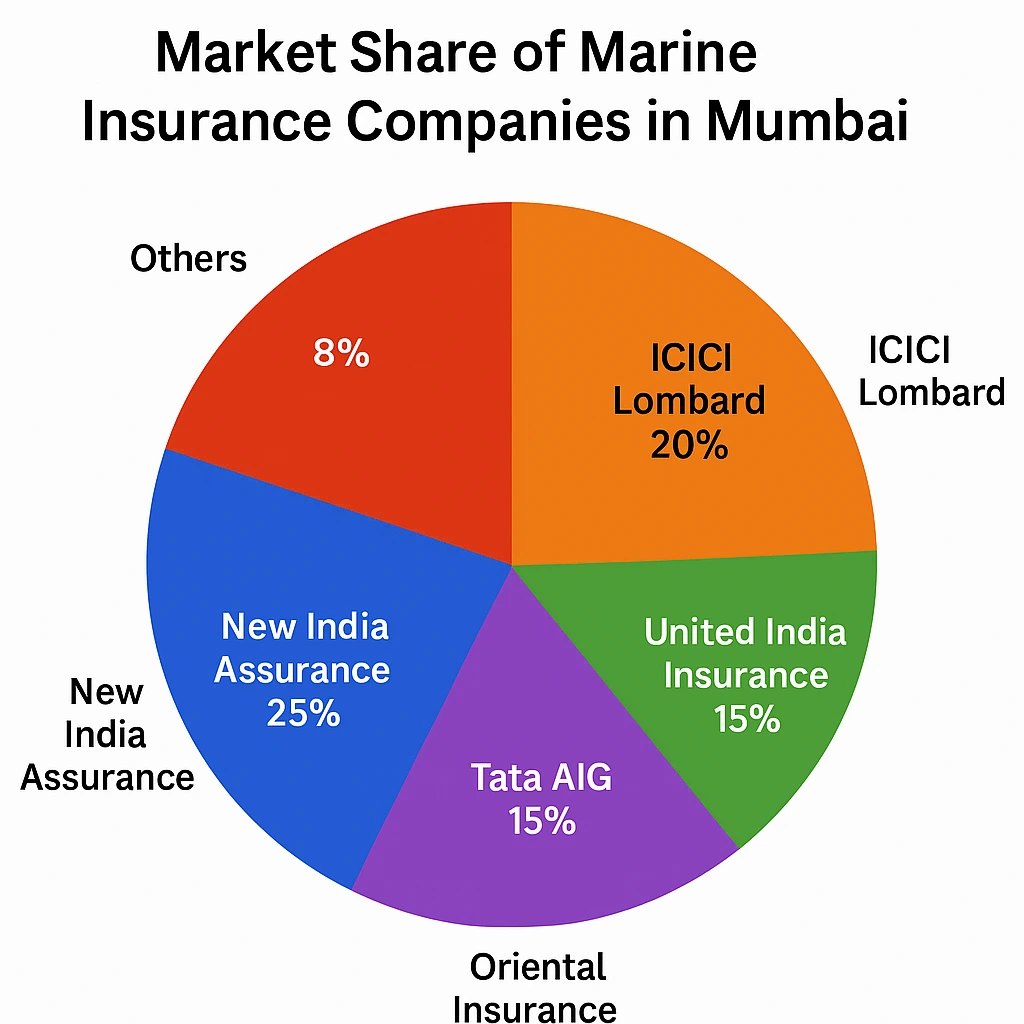

| Company | Approx. Market Share (%) |

|---|---|

| New India Assurance | 25% |

| ICICI Lombard | 20% |

| United India Insurance | 15% |

| Tata AIG | 15% |

| HDFC ERGO | 10% |

| Oriental Insurance | 10% |

| Others (small & niche players) | 5% |

Cost of Marine Insurance in Mumbai

Factors Affecting Premium

- Type and value of cargo

- Distance covered

- Route risk (war zones, piracy, etc.)

- Ship age and condition

Tips to Reduce Premium Costs

- Choose experienced carriers

- Use protective packaging

- Avoid high-risk routes

- Negotiate for bulk coverage

Benefits of Buying Marine Insurance in Mumbai

Fast Access to Services

Being in a major city gives quick access to offices and service centers.

Local Support and Physical Presence

Face-to-face support matters, especially during claims and documentation.

Challenges Faced by Marine Insurance Sector in Mumbai

Regulatory Issues

Complex compliance regulations can delay claim settlements or approvals.

Risk of Maritime Frauds

Fake documentation and cargo fraud are growing concerns for insurers.

Role of IRDAI in Regulating Marine Insurance

The Insurance Regulatory and Development Authority of India (IRDAI) ensures that insurers follow ethical practices, maintain solvency, and treat customers fairly.

Online vs Offline Marine Insurance in Mumbai

| Feature | Online | Offline |

|---|---|---|

| Convenience | High | Medium |

| Human Support | Limited | High |

| Speed of Process | Fast | Slower |

| Policy Customization | Basic | More flexible |

Online is ideal for tech-savvy users; offline works better for personalized service.

Case Studies of Successful Marine Insurance Claims

- Case 1: A textile exporter in Mumbai recovered ₹50 lakhs after a fire destroyed his shipment en route to Dubai.

- Case 2: A shipowner claimed ₹1.2 crores after collision damage, processed within 3 weeks by ICICI Lombard.

Future of Marine Insurance in Mumbai

The marine insurance market is expected to grow by 15% annually. With blockchain integration, AI-driven underwriting, and real-time tracking, the future looks exciting.

FAQ’s

What documents are required to buy marine insurance in Mumbai?

You’ll need a bill of lading, invoice, packing list, and insurance proposal form.

Can I buy marine insurance online in Mumbai?

Yes, most top insurers like ICICI Lombard and HDFC ERGO offer quick online policies.

How are marine insurance premiums calculated?

Based on cargo value, route risk, vessel condition, and distance.

Is marine insurance mandatory in India?

It’s not mandatory by law, but most shipping and freight contracts require it.

How fast are claims settled by Mumbai-based marine insurance companies?

Typically within 15–30 days, depending on documentation and policy terms.