What is Family Floater Health Insurance?

Understanding Family Floater Health Insurance

Health insurance plans for individuals can be expensive and inefficient, with premiums up to 30% higher, complex management, and limited flexibility.

It may be useful to purchase Family floater Health Insurance in this situation. Approximately 40% of individuals with separate plans face coverage gaps and high out-of-pocket expenses.

When compared to individual insurance policies, family floater plans offer comprehensive coverage and can save up to 30%. As a result, the sum insured is a cost-effective and convenient arrangement for all members.

The benefits are available to all family members up to the maximum amount insured, providing financial protection in case of medical emergencies.

Families floater policies are growing in popularity by 15% annually, reflecting the 8-12% increase in health care inflation each year, according to the Bureau of Labor Statistics.

As a result of the increased use of digital technology, there has been a 25% increase in people buying insurance policies online in the last two years.

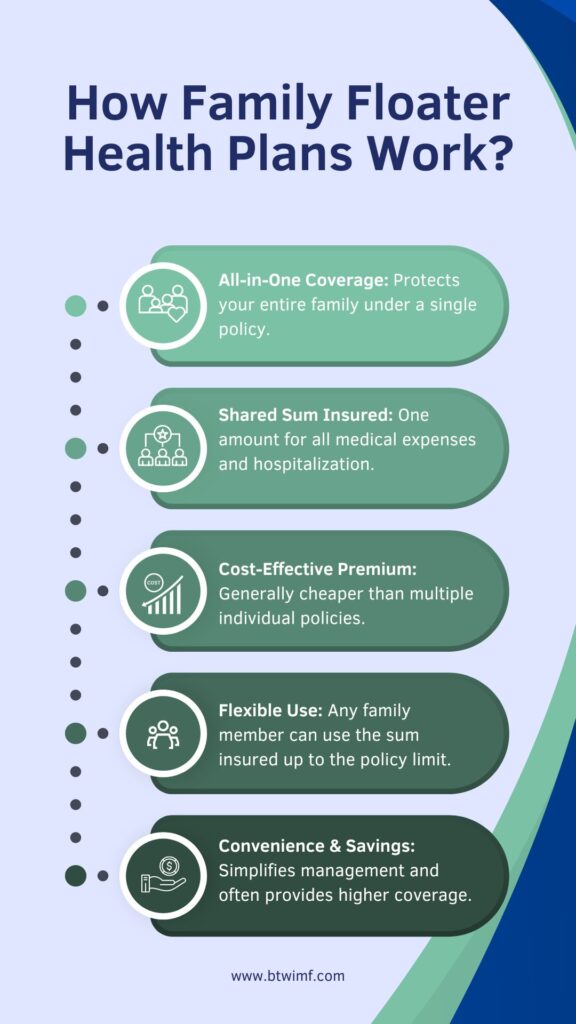

Family Floater Health Plans: How Do They Work?

The Family Floater health insurance plan covers the entire family under one policy. It generally works like this:

- Coverage for the Family: Instead of having individual health insurance policies for each family member, a Family Floater plan covers the entire family (typically spouses, children, and parents with dependent children).

- Sum Insured: All family members covered by the policy have access to the defined sum insured amount in case of hospitalization or medical expenses.

- Premium: In general, a Family Floater plan’s premium is less than the premium of multiple policies for each family member. Based on factors such as the eldest member’s age, the sum insured, and the extent of coverage, the amount of insurance is calculated.

- Usage of Sum Insured: As long as the policy specifies a maximum limit, any member of the covered family can use the sum insured. Other members of the family can make claims within the policy period if one family member uses part of the sum insured.

- Renewal: Floater plans for families are usually renewable annually. When renewing an insurance policy, premiums may be adjusted based on the health status of insured members.

- Advantages: In addition to being convenient and cost-effective, family policies cover the entire household under one policy, eliminate the hassle of managing multiple policies, and often provide a higher sum insured than individual policies.

The family floater plan is a popular option for families seeking comprehensive health insurance coverage in one package.

Example

For example, consider a floater policy covering four family members with a sum insured of Rs 300,000. Within the policy period, any family member can use the remaining Rs 5,000 for any medical expenses related to the eldest member’s surgery.

Family Floater Health Insurance Plans Are Ideal For:

1. Families with Dependents:

If you have dependent family members, such as a spouse, children, or elderly parents, a family floater plan covers everyone. In this way, it becomes easier to manage and everyone is protected.

2. Young Families:

In the early stages of starting a family, newlyweds or young couples can benefit from a family floater plan. This helps start families off right by covering maternity expenses and providing health coverage for parents and their newborns.

3. Budget-Conscious Families:

When you want to manage healthcare costs better, a family floater plan can often be more affordable than buying separate policies for each member of your family. In addition to providing good coverage, the combined premium is lower.

4. Families with Health Concerns:

It’s a good idea to consider a family floater plan if you have a history of certain health issues in your family. It can give you more coverage and ensure everyone gets the care they need at a reasonable price.

5. Those Wanting Comprehensive Coverage:

If you want a single plan that covers all medical needs, like hospital stays, minor procedures, and sometimes wellness benefits, a family floater plan is a great choice. It simplifies your healthcare coverage.

6. Elderly Couples:

When it comes to family floater plans, some are designed to cover older family members, so you can make sure your elderly parents are covered.

7. Those Wanting Simplicity:

The easiest way to manage multiple individual policies is to insure your whole family under one policy. In this way, premiums can be paid and policies can be renewed more easily.

8. Families with Children or Teens:

A family floater plan often covers routine checkups, vaccinations, and emergencies, keeping your kids healthy and protected.

9. Families Going Through Changes:

When families experience big changes, like moving or switching jobs, floaters offer stability in health insurance coverage, which means there will be no gaps in coverage.

The Benefits Of Family Floater Health Insurance

1. Financial Protection

Family floater health insurance provides financial protection, which is one of its major benefits. As medical costs rise, families can face significant financial burdens during medical emergencies when they do not have adequate health insurance.

2. Coverage for All Family Members

A family floater plan will generally cover a wide range of family members, including spouses, children, parents, and sometimes even extended family members. In this way, you ensure that your loved ones are all covered by the same policy.

3. No Claim Bonus

The no-claim bonus is offered by most family floater health insurance policies, which increases the sum insured each year that the policy remains claim-free. It encourages families to maintain good health and seek preventive care by rewarding them for doing so.

4. Tax Benefits

Under Section 80D of the Income Tax Act, premiums paid for family floater health insurance can be deducted from taxable income. As a result, health insurance can be more affordable, leading to significant savings.

5. Convenience

Claim processing is simplified when a single policy covers the entire family. Instead of dealing with multiple insurance providers during hospitalization, the family can concentrate on recovering.

Considerations When Choosing Family Floater Health Insurance

While family floater health insurance has numerous benefits, there are several factors to consider before purchasing a policy:

1. Age of Family Members

The age of the insured family members can significantly impact the premium. Older individuals may lead to higher premiums, so it’s essential to evaluate the age distribution in your family before choosing a plan.

2. Pre-existing Conditions

If any family member has pre-existing health conditions, it’s crucial to check the waiting period for coverage related to those conditions. Some policies may impose waiting periods that can range from a few months to several years.

3. Coverage Limits

Review the coverage limits and exclusions in the policy. Ensure that the sum insured is adequate for your family’s healthcare needs, especially in the case of major illnesses or surgeries.

4. Network Hospitals

Check the list of network hospitals associated with the insurance provider. Ensure that reputable hospitals in your area are included, as this can affect your access to quality healthcare.

5. Renewal Terms

Understand the renewal terms and conditions of the policy. Some insurers may have age limits for renewals, which can affect long-term coverage.

Conclusion

With family floater health insurance, families can receive comprehensive coverage under one policy, providing them with financial protection against unanticipated medical expenses.

It’s cost-effective, convenient, and flexible, but it requires careful consideration of your family’s needs, such as age, pre-existing conditions, and coverage limits.

In addition to protecting your family’s health, family floater health insurance gives you peace of mind during unexpected medical emergencies.

The rising cost of healthcare makes it even more important to have a solid plan.

Make sure that your family has the right type of insurance policy to ensure a healthier future.

FAQ: Family Floater Health Insurance

- Can a Family Floater policy cover both traditional and alternative medicine treatments?

Yes, some Family Floater policies may include coverage for alternative treatments such as Ayurveda, Homeopathy, or Acupuncture. It’s important to check the specifics with your insurer to ensure these treatments are covered under your plan.

- Can I include extended family members in a Family Floater policy?

Most Family Floater plans cover the policyholder, spouse, and children. Some insurers may also allow coverage for parents or in-laws, but this can vary by provider. It’s important to check with your insurer for specific eligibility criteria.

- How is the sum insured shared among family members?

The sum insured is a shared limit for all insured members. For instance, if the sum insured is ₹500,000, it means that up to ₹500,000 can be used by the entire family collectively throughout the policy year. The amount used by one member reduces the remaining amount available for others.

- What happens if one family member exhausts the sum insured?

Once the total sum insured is exhausted, no further claims can be made under the same policy for the current policy year. This makes it crucial to choose an adequate sum insured based on the family’s health needs and potential medical expenses.

- Are pre-existing conditions covered under Family Floater plans?

Coverage for pre-existing conditions varies by insurer and plan. Many Family Floater policies have a waiting period before pre-existing conditions are covered. It’s advisable to review the policy documents or consult with the insurance provider to understand the specifics.

- Can I add more members to the policy later on?

Most Family Floater policies allow you to add new family members, such as a newborn child, by updating the policy. Some insurers may have specific terms and conditions for adding members, so it’s best to check with them for details.

- How do premiums for Family Floater plans compare to individual policies?

Family Floater plans often have lower premiums compared to the total cost of individual policies for each family member. However, the exact premium depends on factors like the sum insured, age of members, and coverage options.

- What are the common exclusions in Family Floater Health Insurance?

Common exclusions might include pre-existing conditions during the waiting period, certain high-risk activities, and cosmetic procedures. It’s essential to read the policy documents carefully to understand what is and isn’t covered.

- How can I choose the right Family Floater plan for my family?

To select the best Family Floater plan, consider factors like the sum insured, coverage benefits, network hospitals, and premium costs. Assess your family’s health needs and financial situation to choose a plan that offers the right balance between coverage and affordability.

- Can Family Floater policies help with preventive care?

Some Family Floater policies offer coverage for preventive health check-ups, vaccinations, and wellness programs. Check with your insurer to see if these benefits are included and if there are any limits or conditions attached.

- What should I do if I need to make a claim?

To make a claim, you typically need to inform the insurer, provide necessary documents, and follow the claims process outlined in your policy. This may include hospital bills, medical reports, and a claim form. Promptly notifying your insurer can help ensure a smoother claims experience.

- How does a Family Floater policy handle coverage if a family member travels abroad?

Family Floater policies usually cover medical emergencies abroad, but coverage details can vary. Verify with your insurer if international coverage is included and if there are any limits or exclusions for overseas medical expenses.

- What impact does a family member’s chronic illness have on the policy’s premium renewal?

A chronic illness in one family member might not directly affect the premium at renewal, as Family Floater policies generally renew based on the overall risk profile of the entire family. However, the insurer may adjust premiums based on claim history or policy terms.

- Can a Family Floater policy be used for outpatient consultations and treatments?

Some Family Floater policies include coverage for outpatient consultations and treatments, such as doctor visits, diagnostic tests, and minor procedures. Check the policy details to confirm what outpatient services are covered.

- How does a Family Floater policy address health coverage if a family member is undergoing a long-term treatment?

Long-term treatments can exhaust the sum insured more quickly. If a family member requires ongoing treatment, the policy may cover these expenses until the sum insured is depleted. It’s important to choose an adequate sum insured and understand how long-term treatments are managed under the policy.

- What happens to the coverage if a family member moves out of the household?

If a family member covered under the policy moves out, you might need to update the policy to reflect the change. Some insurers allow continued coverage for moved-out members, but it’s essential to review the policy terms and inform the insurer.

- Are there any specific benefits for families with young children in a Family Floater policy?

Some Family Floater policies offer additional benefits for young children, such as coverage for vaccinations, pediatric consultations, or wellness check-ups. Explore these benefits to see if they align with your family’s needs.

- Can a Family Floater policy be used to cover family members who are living with disabilities?

Yes, a Family Floater policy can cover family members with disabilities, but it’s crucial to disclose any pre-existing conditions and disabilities during the policy purchase. Ensure that the policy provides adequate coverage for specific needs and treatments.

- How does the policy handle coverage if a family member is pregnant?

Pregnancy-related expenses might be covered under some Family Floater policies, including maternity benefits and newborn care. Check the policy to understand the extent of coverage for maternity and childbirth, including any waiting periods.

- Can a Family Floater policy be customized for specific health needs or preferences?

Many insurers offer customizable Family Floater policies where you can choose additional riders or benefits based on your family’s unique health needs. This could include coverage for critical illnesses, wellness programs, or specific diseases.

- How does the policy support preventive health measures for the whole family?

Some Family Floater policies offer support for preventive health measures, such as annual health check-ups, screenings, and wellness incentives. Investigate these features to promote proactive health management for your family.

- What are the advantages of choosing a Family Floater policy over multiple individual plans in terms of tax benefits?

A Family Floater policy might offer better tax benefits under provisions such as Section 80D of the Income Tax Act, compared to individual plans. Check with a tax advisor to understand how different policy types impact your tax savings.