Table of Contents:

- The Biggest Health Insurance Myth

- Why Healthy People Should Buy Health Insurance Now

- Key Benefits of Early Purchase

- Risks of Delaying Health Insurance

- Real-Life Scenarios that Prove the Point

- How BTW IMF Helps You Choose the Right Policy

- FAQs

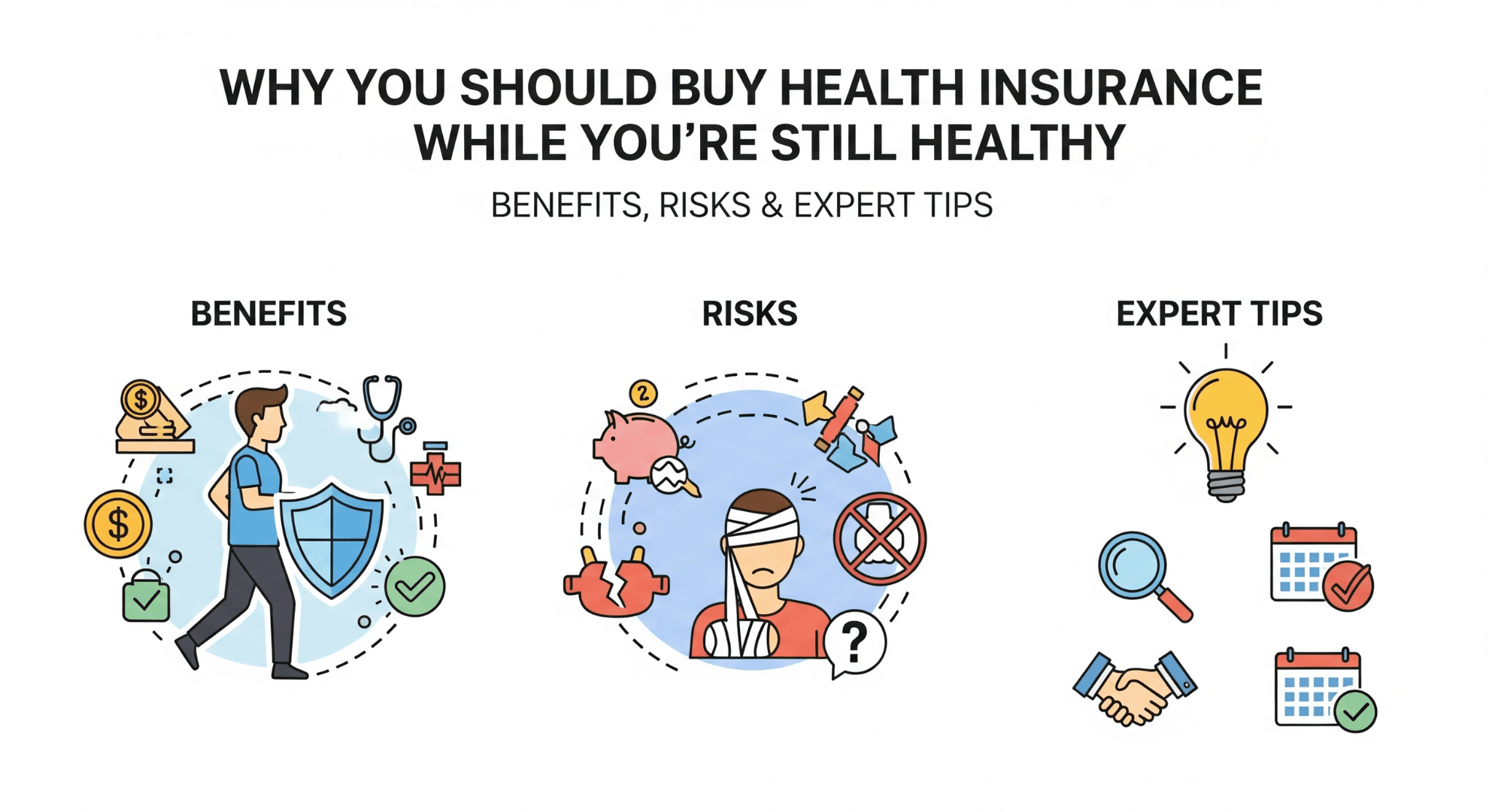

The Biggest Health Insurance Myth

One of the most common misconceptions is that health insurance is only necessary for those with existing health issues. The reality is quite the opposite — the best time to purchase a health insurance policy is when you’re in good health.

Buying early means:

- Lower costs

- Higher chances of approval

- Wider coverage options

- Faster access to benefits

Unfortunately, many people wait until a health scare forces them to act — often when it’s too late to secure the best terms.

Why Healthy People Should Buy Health Insurance Now

Health insurance is not a product you buy only when you need it — it’s a safety net you put in place before the need arises. By applying when you’re healthy, you present minimal risk to the insurer, which works in your favor in multiple ways. Whether you’re a young professional, a parent with dependents, or someone in their 40s planning for the future, acting early can save you from unnecessary costs and complications later.

Key Benefits of Early Purchase

Here’s why securing your policy now is a wise financial decision:

- Lower Premiums

Insurance premiums are directly linked to your age and health status. Younger and healthier applicants pay significantly less for the same coverage compared to older individuals or those with medical conditions.

- No Claim Rejections

When you have a clean medical history, underwriting is straightforward. There are no “red flags” for insurers, so your chances of policy approval are higher.

- Shorter Waiting Periods

Most health insurance policies impose a waiting period for pre-existing diseases, typically 2–4 years. By buying early, you can complete this period before health issues arise.

- Full Policy Benefits

Healthy applicants qualify for a wider range of coverage options and valuable add-ons like maternity cover, critical illness benefits, or wellness perks.

- Peace of Mind

When emergencies strike, you won’t have to worry about arranging funds or being denied coverage — you’ll already be protected.

Risks of Delaying Health Insurance

Waiting to purchase health insurance can have serious consequences:

- Higher Premiums

Premiums rise significantly as you age, even without serious illnesses.

- Limited Coverage Options

If you develop a health condition, insurers may exclude it from coverage or deny your application altogether.

- Longer Waiting Periods

If you apply after being diagnosed with a condition, you’ll have to wait longer before receiving coverage for it.

- Claim Rejection Risks

Delaying can lead to late disclosures of medical history, which may result in rejected claims.

Real-Life Scenarios that Prove the Point

- Case 1: Ramesh, 28, bought health insurance with a ₹10,000 premium. His friend Amit waited until he was 38 and diagnosed with hypertension. Amit’s premium was ₹20,000 — double the cost — and his policy excluded hypertension for the first 4 years.

- Case 2: Priya, 32, purchased a family floater plan before her pregnancy. She was covered for maternity expenses. Her colleague Meera waited until after pregnancy and found maternity coverage unavailable to her.

These examples show why acting early is always the smarter choice.

How BTW IMF Helps You Choose the Right Policy

At BTW Financial Services & IMF Pvt. Ltd., we provide end-to-end guidance for securing health insurance that fits your lifestyle and budget. Our services include:

- Plan Selection: Matching your needs with the best available policies

- Cost Optimization: Advising on the ideal sum insured and add-ons to maximize benefits without overspending

- Documentation Support: Ensuring a smooth application and approval process

- Ongoing Assistance: Helping you manage renewals and coverage upgrades

FAQ’s

Q1. Why is it better to buy health insurance when I’m healthy?

Healthy applicants enjoy lower premiums, wider coverage, and fewer exclusions.

Q2. What happens if I delay buying health insurance?

You may face higher premiums, longer waiting periods, and possible claim rejections.

Q3. Can insurers reject my application if I’m unwell?

Yes, serious pre-existing conditions can lead to rejections or exclusions.

Q4. Does age affect my premium?

Absolutely — premiums increase with age, even without illnesses.

Q5. What is the waiting period for pre-existing conditions?

Typically 2–4 years, depending on the insurer and plan.